An introduction to technical analysis price patterns for stock traders

Technical analysis is a widely used approach to predicting changes in stock prices. By analysing past price movements and identifying specific patterns, traders can develop strategies for anticipating future fluctuations in the market.

Technical analysts and experienced online brokers like Saxo Bank use many different price patterns to predict future trends. Most common patterns include head-and-shoulders formations, double tops and bottoms, triangles, wedges, flags and pennants. Each pattern has its characteristics and is associated with specific trading strategies.

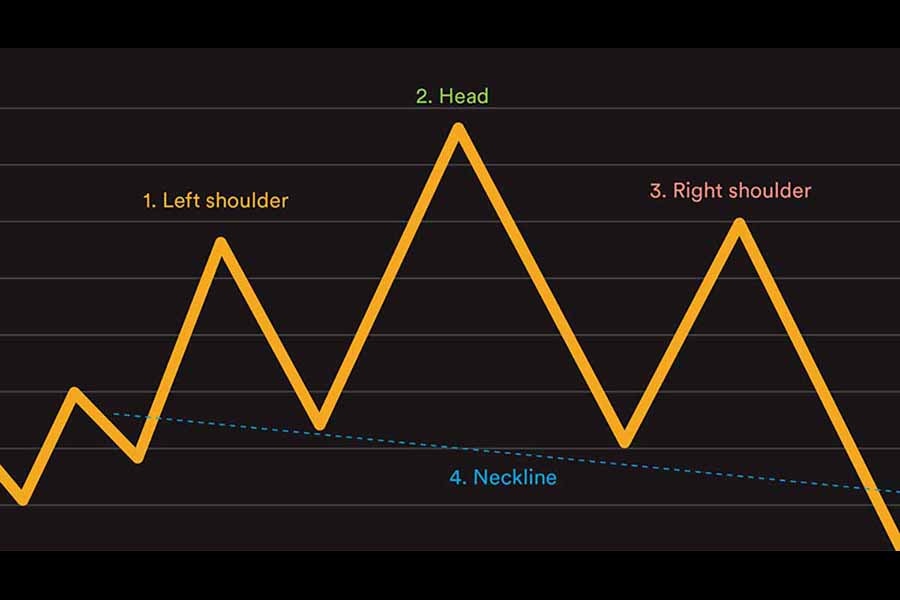

Head-and-shoulders formations

Head-and-shoulder formations often signal that a trend reversal is likely to occur soon. This pattern consists of three successive highs or lows followed by a break below or above the middle peak. Traders who spot this pattern can use a short-selling strategy to take advantage of the predicted downturn.

Double tops and bottoms

Double tops and bottoms often signal that a trend reversal will likely occur soon. This pattern consists of two successive highs or lows followed by a break below or above the middle peak. Traders who spot this pattern can use a short-selling strategy to take advantage of the predicted downturn.

Triangles

Triangles are one of the most commonly used price patterns in technical analysis, indicating either upward or downward trends in stock prices. These patterns form when there is a high trading volume at specific price points, indicating that traders may be positioning themselves for upcoming market movements. Upward-sloping triangles usually signal an uptrend, while downward-sloping triangles usually signal a downtrend.

Wedges

Wedges are another typical technical analysis price pattern, indicating the potential for a sharp price movement in either direction. Wedge patterns can be created by an upward or downward trend that moves higher or lower until it reaches a certain point and starts moving back in the opposite direction. Traders who recognise this pattern may use short-selling strategies to profit from the predicted reversal.

Flags and pennants

Similar to wedges, flags and pennants indicate that a sharp price movement will likely occur soon. These patterns take shape when there is a steady increase or decrease in stock prices over time, followed by a brief period of consolidation before the trend resumes. In most cases, traders who spot these patterns will use short-selling strategies to make good use of the predicted price movement.

What are the benefits of using technical analysis price patterns?

One of the main benefits of using technical analysis price patterns is that they provide traders with a tool for anticipating movements in stock prices. By analysing past price trends and identifying specific patterns, traders can develop strategies for recognising and taking advantage of market fluctuations.

Additionally, these patterns are often based on factors such as volume and trading activity, which can help traders better understand what is driving market movements. Furthermore, technical analysis allows traders to identify potential entry points into the market by pinpointing times when stocks are overbought or oversold.

Technical analysis price patterns offer a valuable framework for improving stock trading decision-making and helping traders maximise their profits in the marketplace.

What are the drawbacks of using technical analysis price patterns?

While technical analysis can be a valuable tool for stock traders, there are also some drawbacks. First, price patterns are often based on historical data and may only sometimes accurately predict future movements in the market.

Additionally, these patterns rely heavily on factors such as volume and trading activity that are only sometimes fully understood or predictable. Furthermore, these patterns can be complex and require significant expertise to master effectively.

The bottom line

Overall, while technical analysis price patterns offer many benefits for stock traders, they should be used with caution and combined with other methods to minimise risks and maximise returns. While traders can use various technical analysis price patterns to predict stock market trends, they need to know their characteristics and understand how they may influence future market movements. By carefully studying price charts and identifying specific patterns, traders can develop strategies to anticipate changes in stock prices and maximise their chances when trading.