How Your Credit Score Influences Your Auto Loan Rate

[ad_1]

The most critical part of an car-loan is arguably the interest rate. It straight influences the size of regular payments and in general bank loan tenor. Desire charges can even participate in a position in the last purchasing conclusion, powerful sufficient to override sentimental purchase motives such as brand loyalty. It goes with out stating, thus, that prospective automobile customers spend focus to variables that identify their desire premiums when procuring for auto-financing possibilities.

A person of this sort of aspects is the credit history rating. It is primarily a weighted rating that tells automobile-creditors how much chance they are getting on by working with a possible borrower. You most likely have a credit report if you have any credit score accounts, these types of as credit history playing cards, mortgages or financial loans. This report then kinds the basis for deciding your credit history score.

It is not an correct evaluate, but it does get rid of light-weight on aspects these types of as the borrower’s willingness and capacity to provider the financial loan. Just put, the much better your credit rating score, the larger your chances of securing an vehicle personal loan with favourable desire prices. This is specially important today as we navigate the era of desire amount hikes and inflationary pressures.

Employing your credit history rating to secure the most effective interest premiums

Via Experian

The total objective of the credit score is common. Nonetheless, diverse lenders in unique components of the environment have their very own standards to measure an individual’s creditworthiness. When you use for an car personal loan in the US, the lender will operate a credit score test as part of the system. The the greater part of the lending establishments use FICO credit scores. This is a 3-digit score assigned to a borrower just after the credit check out exercising.

It was in the beginning created in 1989 by a details analytics corporation referred to as Reasonable Isaac Corporation. Now, there are many versions of the FICO algorithm (and other scoring types, for that make a difference), but they are all aimed at ascertaining the borrower’s capacity to acquire on credit score.

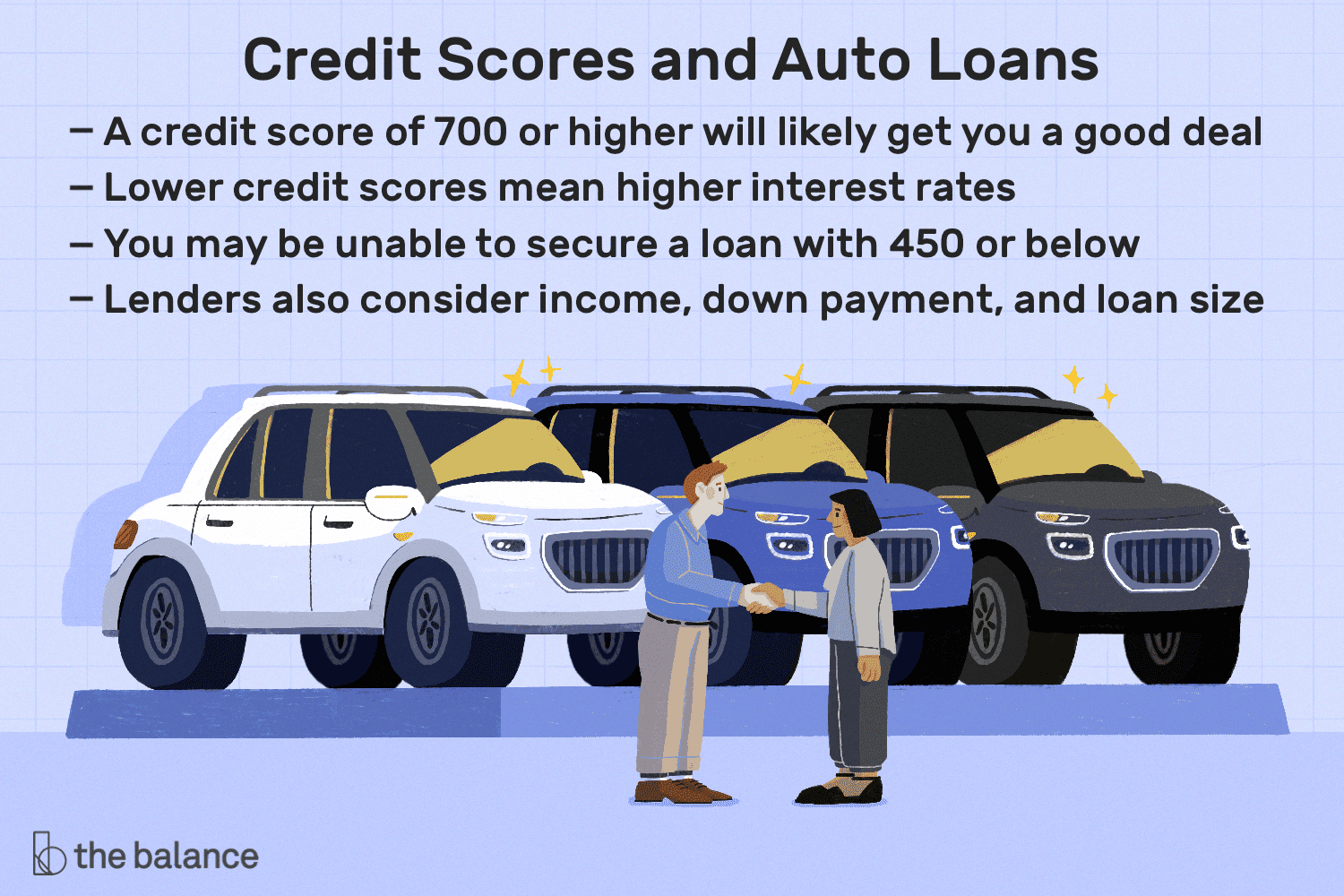

Through The Balance

In accordance to the CFPB (Shopper Money Safety Bureau) Purchaser Credit rating Panel, there are five various borrower profiles sorted into the adhering to credit history rating buckets: Super-prime (720 & earlier mentioned) Key (660-719) Near-primary (620-659) Subprime (580-619) Deep subprime (underneath 580). A borrower with a score underneath 660 can nonetheless secure automobile financial loans, but they will be extra highly-priced than a Prime or Tremendous-key borrower with a rating north of 661. The logic right here is that you will want to hold your credit rating as higher as achievable to get the greatest discounts when searching for car financial loans.

Matters that harm your credit rating rating

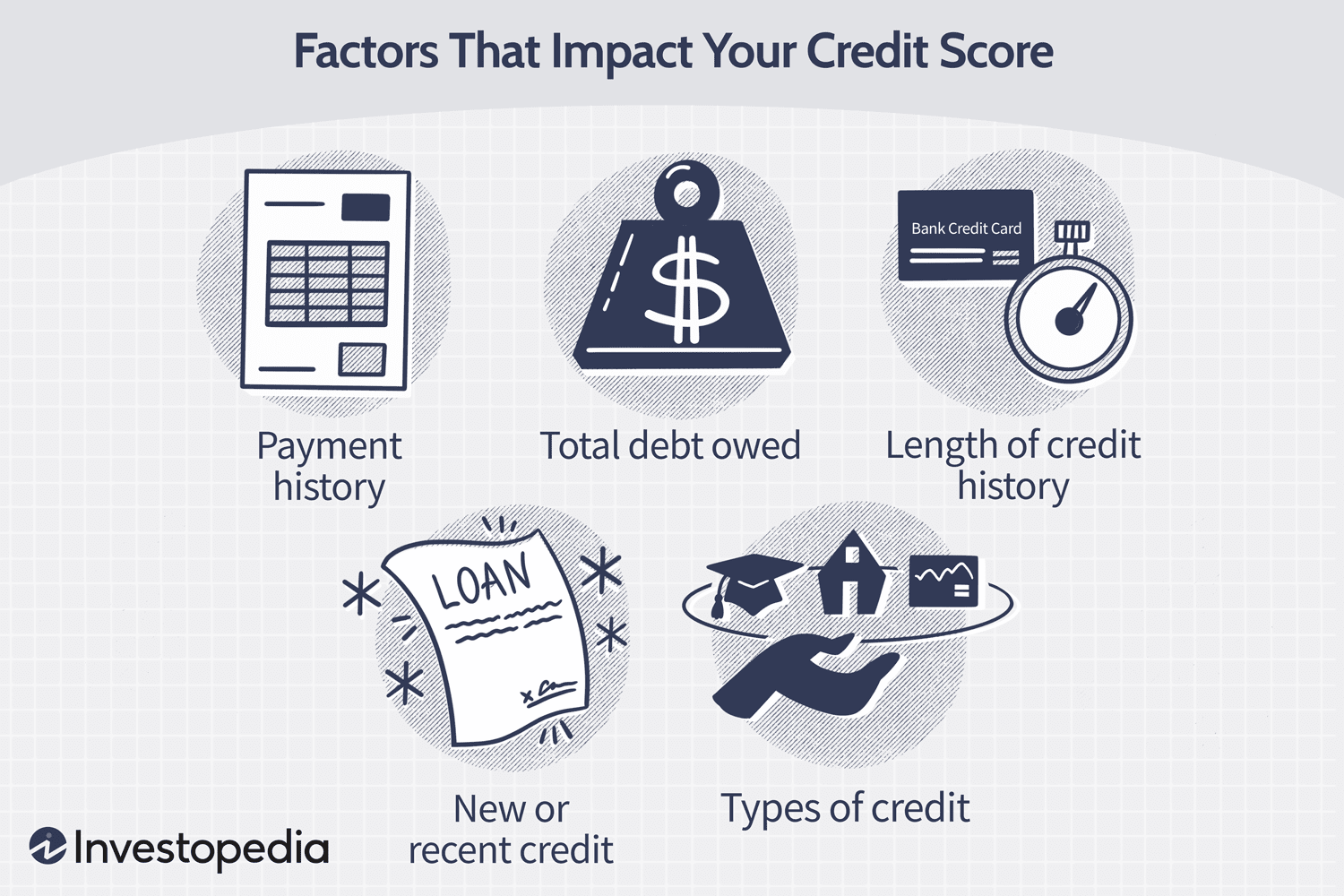

By means of Investopedia

An exceptional credit score rating is the outcome of cautious and deliberate planning, and realizing the prospective pitfalls can assist the borrower avoid generating missteps that pull down the rating into unwelcome territory.

Making a late payment

Payment heritage on your credit history obligations accounts for up to 35% of the FICO score. In accordance to FICO, a payment that is 30 times late can value someone with a credit score rating of 780 or higher any place from 90 to 110 details. It is essential to make payments as at when due and proactively arrive at out to the loan provider if, for any rationale, payment will be delayed.

A large personal debt-to-credit rating utilization ratio

Credit score heritage is designed by a consistent cycle of credit utilization and spend downs. On the other hand, you will want to hold an eye on the proportion of your debt load to overall credit history. The decrease your balances relative to your whole available credit, the superior your rating will be.

Non-utilization of credit rating

On the other hand, no credit background for an prolonged period can also adversely influence the borrower’s credit score. Loan companies and collectors have nothing to report to credit bureaus when you never benefit from your credit score accounts. This will make it extra hard to appraise potential loan purposes.

Personal bankruptcy

Filing for bankruptcy has one particular of the most major impacts on your credit rating rating. It can wipe as considerably as 240 points from an individual’s score, and what’s extra? A personal bankruptcy report can stay on the credit history heritage for up to ten several years.

This list is by no means exhaustive, and other factors these as frequency of credit applications, credit history card closure, charge-offs and refinancing all affect credit score scores in various levels.

Improving your credit rating rating

Enhancing your credit rating rating will require avoiding the pitfalls before determined higher than. Techniques such as prompt and frequent invoice payments, keeping a minimal credit card debt-to-credit history utilization ratio (ideally about 30%), holding credit score card accounts open and steering clear of many financial loan apps at after are all actions in the proper course.

On the other hand, even with all these ‘building blocks’ in area, a wonderful credit score score is not instantaneous. It may choose a while to see any advancement, especially because adverse stories can keep on your credit score historical past for various a long time. There is no rigid time body for credit history rating development as every single person’s financial problem is special. According to Forbes, it could take anywhere from a month to as a lot as 10 decades. Certainly, this is influenced by factors these kinds of as the individual’s existing credit rating standing and amount of money of full publicity.

Securing automobile financial loans irrespective of credit history rating

By way of Geotab

A superior credit score rating will without doubt increase your probabilities of securing vehicle funding and locking up the most effective interest prices. Nonetheless, it is not all doom-and-gloom for potential vehicle prospective buyers with weak scores as they are not totally without having choices.

Regardless of your credit history score, looking about and thinking about the numerous financing selections is remarkably suggested. It is just like buying for the auto alone an typical customer will examine diverse dealerships and negotiate vigorously in advance of earning the closing final decision.

Financial institutions are the regular resources for obtaining a loan, but you may be proscribing your choices if they are your only thought. Don’t overlook substitute lenders. Doing the job with 3rd-celebration funding firms, these types of as obtaining your vehicle financial loan through LoanCenter.com, may well supply you with favourable interest rates or funding terms.

It is important to be aware that simply getting vehicle-financial loan preapprovals (distinct from precise financial loan programs) whilst procuring all over will not effect your credit score rating considering the fact that most scoring models do not deal with this as a tough enquiry.

In summary, a weak credit score rating may press the least expensive desire premiums out of achieve. Even so, owning a number of choices will boost your odds of discovering a package with an curiosity amount that matches inside of your price range and permit you to acquire your sought after vehicle.

[ad_2]

Supply url