Navigating Malaysia’s Road Tax Landscape: From Fairlady to Checking Your Tax

In the vibrant tapestry of Malaysian vehicle ownership, road tax plays a pivotal role, ensuring the seamless operation of countless automobiles across the nation. From the renowned roadtax Nissan Fairlady to the intricacies of cara semak cukai jalan (how to check road tax) and the implications of harga saman cukai jalan tamat tempoh (late road tax renewal fines), let’s embark on a journey to explore the multifaceted world of road tax in Malaysia.

The Fairlady’s Road Tax

The Nissan Fairlady, an epitome of automotive elegance and performance, graces Malaysian roads with its presence. But to keep this marvel rolling, road tax is essential.

Taxation by Displacement

Road tax in Malaysia is influenced by engine displacement. The roadtax Nissan Fairlady, with its potent engine, falls into a higher road tax bracket. This approach not only generates revenue but also encourages responsible fuel consumption.

The Road Tax Renewal Ritual

Road tax renewal is an annual ritual for vehicle owners in Malaysia. It’s a simple yet essential responsibility that ensures the uninterrupted use of public roads. The process can be completed efficiently, and there are consequences for failing to renew on time.

Online Convenience

With technological advancements, renewing your road tax has become remarkably convenient. One can simply visit the Road Transport Department’s (JPJ) online portal or authorized online platforms to accomplish this task. Gone are the days of queuing at physical offices.

The Consequences of Delay

The harga saman cukai jalan tamat tempoh, or fines for late road tax renewal, are a deterrent against procrastination. Failing to renew your road tax promptly can result in these fines, and driving with an expired road tax can lead to legal consequences.

Checking Your Road Tax

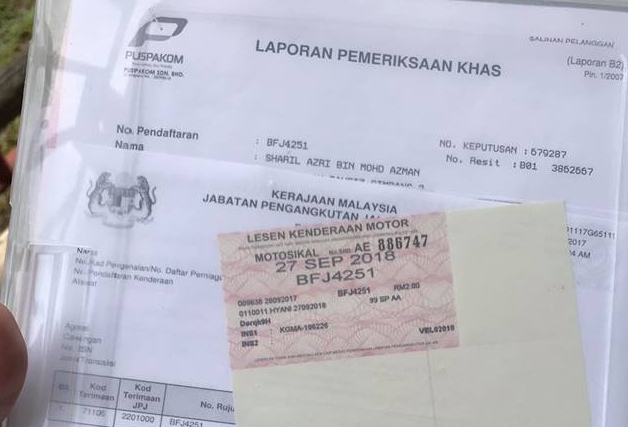

Knowing how to cara semak cukai jalan, or check your road tax, is a valuable skill for every vehicle owner. It allows you to verify your compliance with road tax regulations.

Digital Verification

The digital age has made it easier than ever to check your road tax status. By visiting the JPJ website or using authorized online services, you can input your vehicle’s registration number and swiftly obtain the information you need.

Peace of Mind

Checking your road tax status provides peace of mind. It ensures that you are always on the right side of the law and that your vehicle is protected by insurance in case of unforeseen events.

The Larger Role of Road Tax

Beyond the individual responsibilities and intricacies of road tax management, it plays a significant role in the development and maintenance of Malaysia’s road infrastructure.

Funding Road Development

The revenue generated from road tax is channeled into road maintenance and development projects. This includes the construction of new highways, repairs of existing roads, and the implementation of safety measures.

A Civic Duty

Fulfilling your road tax obligations is not just a legal requirement; it’s a civic duty. By doing so, you contribute to the betterment of the nation’s transportation networks, ensuring safer and more efficient roads for all.

In Conclusion

From the graceful presence of the roadtax Nissan Fairlady to the digital convenience of cara semak cukai jalan, and the deterrence of harga saman cukai jalan tamat tempoh, road tax in Malaysia is a comprehensive system that ensures the nation’s roads are well-maintained and safe.

As a responsible vehicle owner, embracing the digital tools available for road tax renewal and checking your road tax status is paramount. By doing so, you not only comply with legal requirements but also contribute to the growth and upkeep of Malaysia’s essential road infrastructure. It’s a journey of responsibility that keeps both vehicles and nations on the right track.